Our customers work more efficiently and benefit from

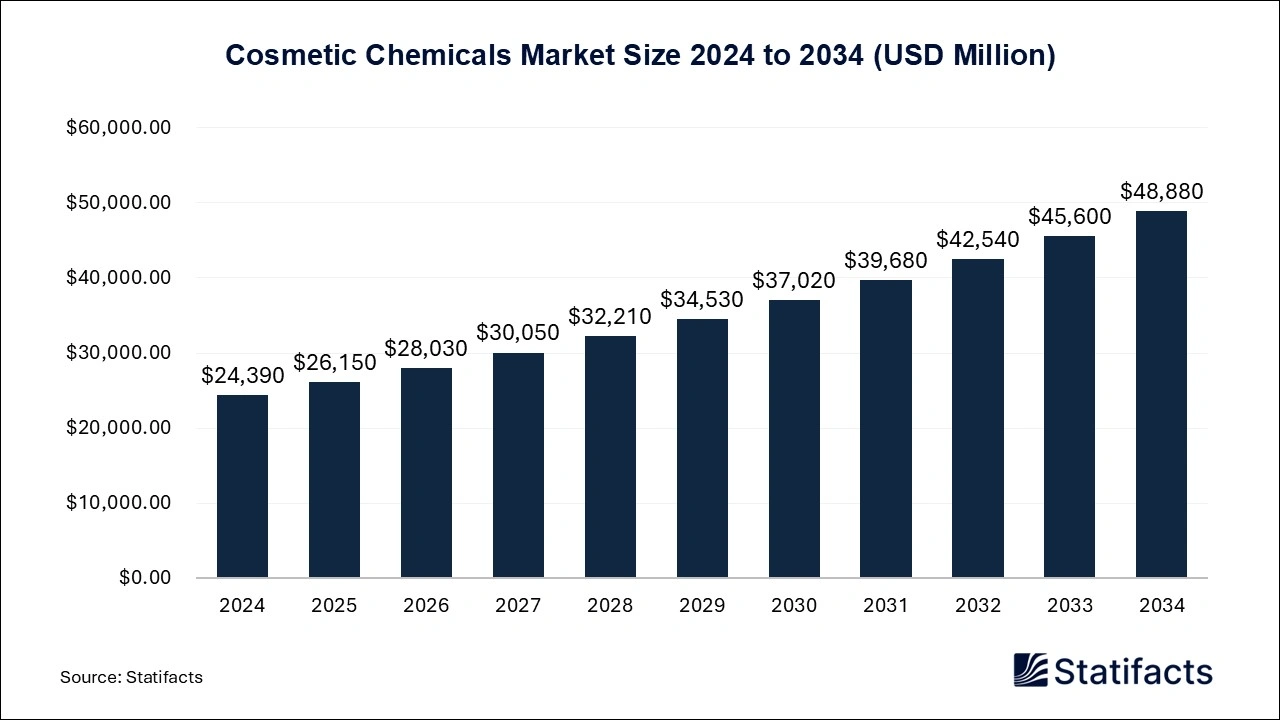

The global cosmetic chemicals market size was estimated at USD 24,390 million in 2024 and is projected to be worth around USD 48,880 million by 2034, growing at a CAGR of 7.2% from 2025 to 2034.

| Industry Worth | Details |

| Market Size in 2025 | USD 26,150 Million |

| Market Size by 2034 | USD 48,880 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.2% |

Cosmetic chemicals are integral to personal and cosmetic products' properties, enhancing texture, aesthetics, shelf life, and product performance. Among some of the most common cosmetic product ingredient categories are colorants, surfactants, emollients, preservatives, and rheological modifiers. The rising demand for such products among consumers interested in high quality and premium, especially incorporating natural ingredients, has decided the market growth. Manufacturers are researching all possible safe and sustainable natural and synthetic alternatives to satisfy consumer demand for skin and health products.

Cosmetic ingredients can be either derived from industrial processes or extracted from natural sources. These include emulsifiers, preservatives, thickening agents, moisturizers, and fragrance or color agents. Synthetic chemicals may originate from natural sources but are deemed synthetic because they have undergone extremely complex processing. Natural ingredients are primary but can be from plant, mineral, animal, or microbial sources.

About 1,500 chemical substances are recognized as cosmetic ingredients around the globe. The most widely used materials in cosmetic formulations are thickening agents, carrier powders, pigments, emollients, moisturizers, and film formers. The cosmetic chemicals market is fragmented, with many small and medium companies supplying various natural and inorganic raw materials.

“As we step into 2025, I speak on behalf of the team at Eternis in expressing my excitement with this significant milestone of completing another overseas acquisition in our growth journey”,

"Our focus has been on growth factors, essential proteins naturally found in the skin that diminish with age, contributing to the aging process.”

The global cosmetic chemicals market is experiencing significant growth, with North America maintaining its position as the dominant region while APAC emerges as the fastest-growing market.

North America

The cosmetic chemicals market is dominated by North America because of the high demand for personal care and beauty products. In the US, consumer perception is changing with a greater focus on health, wellness, and self-care. The manufacturers are creating new enterprise strategies that integrate biotechnology, pharma, and nutritional solutions. Demand for skincare products has been driving an increasing awareness, with the majority of consumers willing to pay for premium formulations perceived as effective. Consumers are interested in products that reflect their values, sustainable manufacturing process, clean labeling, and natural ingredients. With that, major companies are searching for raw materials derived from plants, marine sources, and other unconventional natural resources. New brands are lured into the market on the backs of the changing consumer dynamics and the attraction of clean beauty. This has led to increased investment in research and development of products that support market growth.

Asia-Pacific

Asia-Pacific is expected to be the fastest-growing region within the cosmetic chemicals industry. Urbanization, increasing spending capacity by the consumer, and shifting preferences in beauty are stimulating demand for cosmetic products of good quality and standards. Consumers have become more aware of skincare routines, embracing a host of personal care remedies to suit their needs.

Europe

On the other hand, Europe is experiencing slow yet steady growth in the cosmetic chemicals market, essentially supported by a mature beauty industry that keeps evolving. Consumers are conscious of the constituents of their skincare and cosmetics and demand that brands are accountable. Therefore, companies also invest in innovation to develop their formulations with tight adherence to regulatory frameworks and environmental goal attainment in the region.

The cosmetic chemicals market is highly competitive, with leading pharmaceutical companies such as Lonza Group, Lanxess, Dow Chemical Company, BASF SE, P&G Chemicals, Bayer AG., and Cargill Incorporated in the market.

P&G's fiscal year 2024 net sales were $84.0 billion, a 2% increase from the prior year. The company's net earnings attributable to P&G were $14.9 billion, and its diluted net earnings per common share were $6.59.

According to Bayer's latest financial reports, the company's current revenue (TTM ) is ₹4.310 Trillion, a decrease over the revenue in the year 2023, which was ₹4.308 Trillion.

In 2023, BASF SE's annual revenue was €68.9 billion. For the full year 2024, BASF expects sales to be around €65.3 billion. This represents a decrease from the previous year.

For any questions about this dataset or to discuss customization options, please write to us at sales@statifacts.com

| Stats ID: | 8207 |

| Format: | Databook |

| Published: | April 2025 |

| Delivery: | Immediate |

| Price | US$ 1550 |

| Stats ID: | 8207 |

| Format: | Databook |

| Published: | April 2025 |

| Delivery: | Immediate |

| Price | US$ 1550 |

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Unlock unlimited access to all exclusive market research reports, empowering your business.

Get industry insights at the most affordable plan

Stay ahead of the competition with comprehensive, actionable intelligence at your fingertips!

Learn More Download

Download